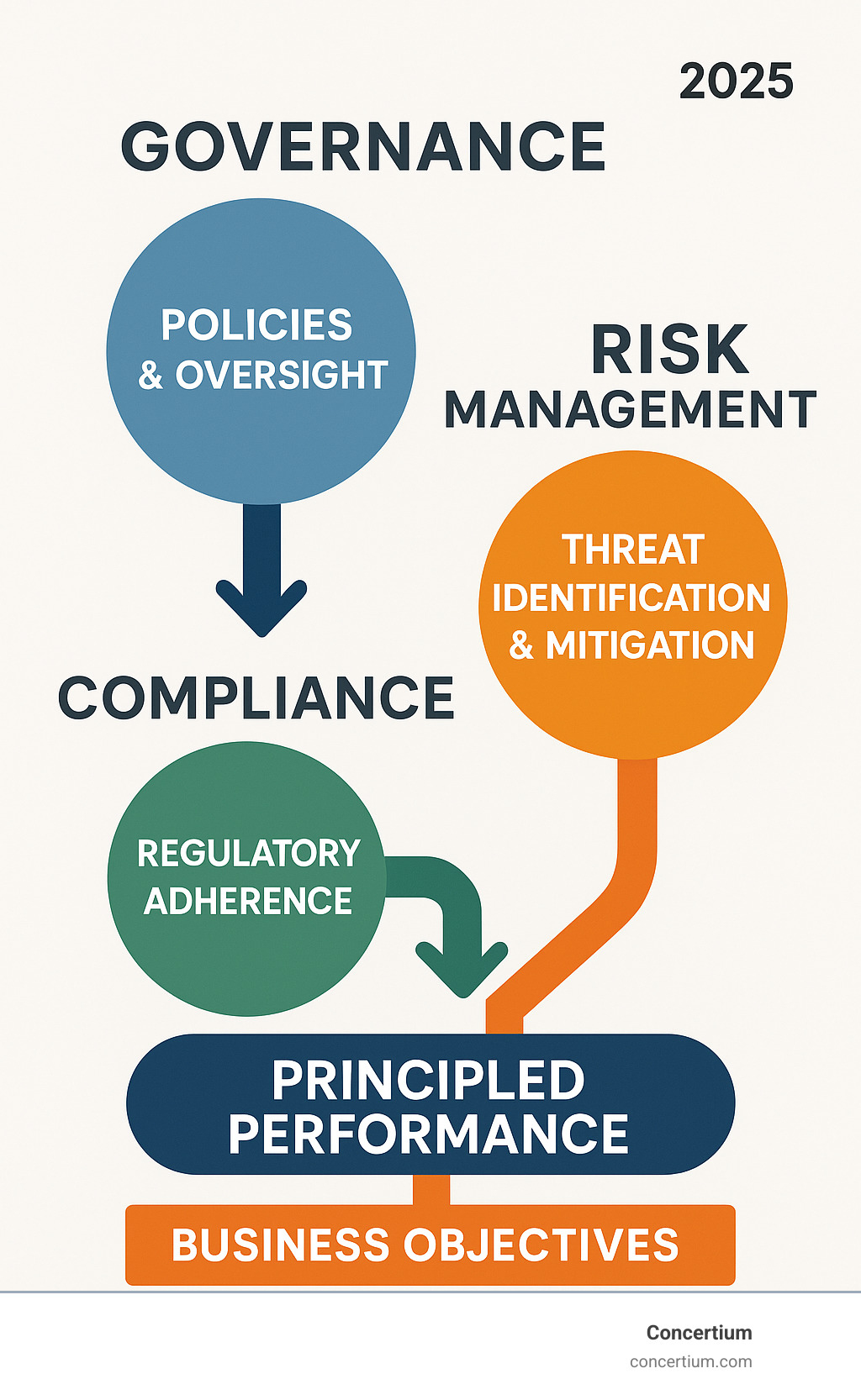

GRC governance is a structured approach that combines Governance, Risk management, and Compliance into one unified framework to help organizations reliably achieve their objectives while managing uncertainty and acting with integrity.

Quick Answer: What is GRC Governance?

- Governance: Rules, policies, and processes that align corporate activities with business goals

- Risk Management: Identifying, assessing, and controlling threats to organizational objectives

- Compliance: Adhering to laws, regulations, and internal policies

- Purpose: Enable “Principled Performance” – achieving goals while managing risks ethically

- Benefit: Reduces costs, eliminates duplicated efforts, and improves decision-making

If you’re a business owner dealing with increasing cyber threats, complex regulations, and limited security expertise, you’re not alone. Research shows that over $1 trillion is lost annually due to unprincipled misconduct, mistakes, and miscalculations – losses that proper GRC governance could prevent.

The problem? Most organizations still manage governance, risk, and compliance in separate silos. This creates blind spots, wastes resources, and leaves you vulnerable to threats you can’t see coming.

GRC governance changes that. Instead of treating these three areas as separate functions, it integrates them into a single, coordinated approach. This means your IT security policies align with your business goals, your risk assessments inform your compliance efforts, and your governance framework supports everything.

The result is what experts call “Principled Performance” – the ability to achieve your business objectives while effectively managing risks and maintaining integrity.

The Three Pillars of GRC: More Than Just an Acronym

When we talk about GRC governance, we’re referring to a holistic strategy that integrates three crucial, yet often disconnected, organizational practices: Governance, Risk Management, and Compliance. While the acronym GRC itself was coined by the Open Compliance and Ethics Group (OCEG) in 2002, and the first peer-reviewed academic paper on the topic was published in 2007 by OCEG founder Scott Mitchell, the underlying concepts have always been vital for businesses.

The core idea is simple: instead of treating these functions as separate, siloed departments, we unify them. Why? Because governance decisions impact risks, risks impact compliance, and compliance failures can lead to governance breakdowns. Managing them together ensures that the right people get the right information at the right times, with the right objectives and controls in place. This integrated approach is critical for achieving operational efficiency and strategic alignment.

As OCEG formally defined it, GRC is “the integrated collection of capabilities that enable an organization to reliably achieve objectives, address uncertainty and act with integrity.” It’s not just a technology or a department; it’s a philosophy of business that permeates the organization’s oversight, processes, and culture.

Let’s break down each pillar:

Governance: The Foundation of Control

Governance, at its heart, is about how an organization is directed and controlled. It’s the framework of rules, policies, processes, and structures that ensures corporate activities are aligned to support business goals. Think of it as the brain of the operation, making sure everything runs smoothly and ethically.

Our research shows that 93% of survey respondents say they have a framework or policy document in place for governance, yet a surprising 48% of companies have no formal corporate governance procedures. This gap highlights a common challenge: having a document is one thing, actively implementing and following it is another.

Effective governance encompasses:

- Board Responsibility: Overseeing the organization’s strategic direction, financial performance, and risk management. Fifty percent of survey respondents have chosen a strategic board archetype, with 72% adding between two and five subcommittees to get hands-on.

- Policies and Procedures: Establishing clear guidelines for operations, decision-making, and employee conduct.

- Accountability: Defining roles and responsibilities, ensuring individuals and departments are answerable for their actions and results.

- Ethical Culture: Fostering an environment where integrity, transparency, and responsible behavior are paramount. This involves balancing the interests of various corporate stakeholders.

- Decision-making: Ensuring that decisions are data-driven, risk-aware, and aligned with the organization’s values and objectives.

Good governance helps us make better decisions, allocate resources wisely, and maintain stakeholder trust. It’s the bedrock upon which successful risk management and compliance efforts are built. For those interested in the IT aspect, exploring IT Governance Risk and Compliance can provide further insights.

Risk management is the process of identifying, assessing, and controlling potential threats that could hinder an organization from achieving its objectives. It’s about being proactive, not just reactive, to the bumps in the road.

We constantly face uncertainties in the business world, from market fluctuations to technological disruptions and, increasingly, cyber threats. Our goal is to minimize the impact of negative events while maximizing positive opportunities.

Key aspects of risk management include:

- Risk Identification: Pinpointing potential risks across all areas of the business—financial, operational, strategic, reputational, and especially cybersecurity.

- Risk Assessment: Evaluating the likelihood and potential impact of identified risks. This helps us prioritize where to focus our efforts.

- Risk Appetite: Defining the level of risk an organization is willing to accept to achieve its objectives. It’s interesting to note that 67% of companies in life sciences say that a well-defined risk appetite is either absent, lagging, or in need of improvement.

- Mitigation Strategies: Developing and implementing controls to reduce or eliminate identified risks. This can involve anything from implementing robust security systems to developing contingency plans.

- Proactive vs. Reactive: Shifting from simply reacting to incidents to anticipating and preventing them. This is where a strong GRC governance approach truly shines.

The average score for risk management capabilities across industries is 2.6 out of 4.0, indicating significant room for improvement. Larger companies generally report more mature capabilities, while 54% of companies in the travel, logistics, and infrastructure (TLI) sector struggle with using stress scenarios effectively. Our focus on Compliance and Risk Assessment helps organizations strengthen this critical pillar.

Compliance: Adhering to the Rules

Compliance is the act of adhering to mandated laws, regulations, industry standards, and internal policies. It’s about playing by the rules, both external and internal, to avoid penalties, legal issues, and reputational damage.

The regulatory landscape is constantly evolving, making compliance an ongoing challenge. From data privacy laws like GDPR and HIPAA to industry-specific standards, the sheer volume of requirements can be overwhelming.

Key elements of compliance include:

- Regulatory Requirements: Adhering to laws and regulations set by government bodies (e.g., HIPAA for healthcare, GDPR for data privacy).

- Industry Standards: Following best practices and guidelines established by specific industries (e.g., PCI DSS for payment card security).

- Internal Policies: Ensuring employees and operations align with the organization’s own established rules and codes of conduct.

- Audits: Regularly reviewing processes and controls to ensure adherence and identify any gaps.

- Whistleblowing Channels: Providing avenues for employees to report concerns, with 52% of respondents describing themselves as leading in providing such channels.

The average score for compliance management across industries is 2.9 out of 4.0, showing a slightly better but still imperfect picture. A significant challenge is that 68% of respondents describe their maturity level as absent, lagging, or in need of improvement regarding ethics and compliance culture feeding through to leadership incentives and bonus structures. This highlights the need to embed compliance deeply into the organizational culture, not just as a checkbox exercise. Learn more about our approach to Cybersecurity Compliance Standards.

Why Integrated GRC Governance is a Strategic Imperative

Historically, governance, risk management, and compliance functions often operated in isolation. Governance teams set policies, risk teams identified threats, and compliance teams ensured adherence to rules. While each function is vital, this siloed approach creates significant inefficiencies and risks. It’s like having three separate engines in a car, each trying to drive independently.

When GRC activities are managed independently, there’s substantial duplication of tasks, leading to increased operational costs and disconnected results. Imagine multiple departments conducting similar risk assessments or audits, each with their own tools and reporting structures. This not only wastes resources but also leads to a lack of visibility across the organization, making it impossible to get a holistic view of our risk posture or compliance status. This is why a unified GRC governance framework is not just a nice-to-have, but a strategic imperative.

The High Cost of a Disconnected Approach

The consequences of a fragmented GRC approach can be severe, extending far beyond mere inconvenience. We’ve seen how a lack of integrated GRC can lead to:

- Financial Losses: As mentioned, over $1 trillion USD is lost annually due to unprincipled misconduct, mistakes, and miscalculations. These are often direct results of governance failures, unmanaged risks, or non-compliance. Disconnected GRC activities prevent us from seeing the full picture, leading to costly surprises.

- Reputational Damage: A major compliance breach or a significant unmanaged risk can severely damage an organization’s reputation, eroding customer trust and stakeholder confidence. It takes years to build a strong brand, but moments to tarnish it.

- Inconsistent Reporting: Without a unified system, compiling accurate and consistent reports on governance, risk, and compliance across different departments becomes a Herculean task. This makes it difficult for leadership to make informed decisions.

- Regulatory Penalties: Non-compliance with regulations can result in hefty fines and legal action. For instance, 48% of companies have no formal corporate governance procedures, and 58% do not use manuals for governance, increasing their vulnerability to such penalties.

The cost of managing risk and compliance separately often outweighs the investment in an integrated solution. This is why understanding the difference between Compliance vs Risk Management in a siloed versus integrated context is crucial.

The Benefits of a Unified GRC Framework

Embracing a unified GRC governance framework transforms these challenges into opportunities. By integrating governance, risk, and compliance activities, we can achieve:

- Reduced Costs: Eliminating duplicated efforts, streamlining processes, and consolidating tools lead to significant cost savings. When GRC is done right, organizations experience reduced duplication of activities and reduced operational impact.

- Improved Decision-Making: A holistic view of governance, risk, and compliance provides leadership with better, more accurate information, enabling data-driven decisions that align with strategic objectives and risk appetite.

- Improved Performance: By proactively managing risks and ensuring compliance, organizations can operate more efficiently and effectively, improving overall business performance. This leads to greater information quality and consistency.

- Agility: A well-integrated GRC framework allows organizations to respond more quickly and effectively to changes in the regulatory landscape, market conditions, or threat environment.

- Resilience: By understanding and mitigating risks across the enterprise, organizations become more resilient to disruptions, protecting their assets and ensuring business continuity.

This integrated approach is the pathway to “Principled Performance,” ensuring we achieve our objectives while acting with integrity and effectively addressing uncertainty.

Key Drivers for Modern GRC Adoption

Several factors are compelling organizations to adopt a more integrated GRC governance approach:

- Regulatory Pressure: The increasing volume and complexity of global regulations (e.g., data privacy, cybersecurity, financial reporting) demand a coordinated response. Businesses need to comply with new or updated regulatory requirements constantly.

- Third-Party Risks: As supply chains become more complex and organizations rely more on third-party vendors, managing the associated risks (e.g., data breaches, compliance failures) requires a robust GRC framework. Complex third-party business relationships increase risk.

- Digital Change and Cybersecurity Threats: The rapid pace of digital change and the escalating sophistication of cyber threats mean that IT systems are now at the forefront of risk and compliance. Internet connectivity introduces cyber risks that threaten users’ data and privacy, making GRC essential for compliance.

- Business Uncertainties: The modern business landscape is characterized by constant change and unforeseen challenges, from economic volatility to geopolitical shifts. GRC helps organizations steer these uncertainties.

- Stakeholder Demands: Investors, customers, and employees increasingly expect organizations to operate ethically, responsibly, and transparently. Strong GRC demonstrates commitment to these values.

The costs of risk management are also increasing at an unprecedented rate, making efficiency and integration paramount. Our Risk Advisory Services in Cybersecurity help address these evolving drivers.

How to Build an Effective GRC Strategy

Implementing a comprehensive GRC governance strategy is a journey, not a destination. It requires careful planning, executive buy-in, and a commitment to continuous improvement. We understand that organizations often face challenges such as managing change, dealing with siloed data, and a lack of a total GRC framework. But with a structured approach, these problems can be overcome.

A successful GRC strategy starts with understanding that it’s a philosophy, not just a set of tools. As one expert put it, GRC is “a new paradigm requiring a common framework, integrated processes, and a platform that spans across the organization and its individual risk and compliance issues.” To begin developing your strategy, consider reviewing resources like Developing a GRC Strategic Plan.

A Practical Guide to GRC Governance Implementation

Here are the key steps we recommend for effectively implementing a GRC governance strategy:

- Assess Current State: Before building, we must understand what we have. This involves identifying interrelated processes, problems, and issues through a survey assessment aimed at cataloging existing processes, technologies, and methodologies. This helps define our GRC maturity level.

- Define Goals and Scope: Clearly articulate what we want our GRC program to achieve. This includes establishing a vision and mission statement, and setting specific, measurable, achievable, relevant, and time-bound (SMART) goals (e.g., reducing vulnerability exposure by 20% or achieving 95% compliance with GDPR).

- Secure Leadership Support: GRC governance must be a top-down initiative. Senior executives must understand the benefits, set the tone for an ethical culture, and champion the effort. Our research indicates that 60% held C-suite or C-suite minus one roles in GRC surveys, highlighting the importance of high-level involvement.

- Select a Framework: Choose a GRC framework (like OCEG’s Capability Model, COSO, or NIST) that aligns with our organizational objectives and industry requirements. This provides a structured approach for integrating governance, risk, and compliance.

- Leverage Technology: Use GRC software solutions to automate tasks, centralize data, and provide real-time insights. This is critical for breaking down silos and improving efficiency.

- Communicate and Train: Ensure all employees understand the importance of GRC, their roles and responsibilities, and how changes will impact them. Transparent information sharing and ongoing training are crucial for change management.

- Monitor and Improve: GRC is not a one-time project. We must continuously monitor performance, assess effectiveness, and adapt our strategy based on new risks, regulations, and organizational changes. This iterative process ensures our GRC program remains robust and relevant.

By following these steps, organizations can systematically build a robust GRC governance framework that supports their strategic objectives. For more detailed strategies, consider our guide on Governance Risk and Compliance (GRC) Strategies.

The Critical Role of Technology and Automation

In today’s complex business environment, technology is not just an enabler for GRC governance; it’s a necessity. Manual processes, spreadsheets, and siloed systems simply cannot keep up with the volume and velocity of information required for effective GRC. Our research shows that 42% of respondents across industries say their use of IT and GRC systems “needs improvement,” and 15% say it is absent or lagging. This highlights a significant opportunity for technological advancement.

GRC software solutions provide a centralized platform for managing all aspects of governance, risk, and compliance. These tools can:

- Automate Repetitive Tasks: From policy management and control testing to audit preparation and reporting, automation reduces manual effort and improves accuracy. Explore how GRC Automation Tools can transform your operations.

- Centralize Data: Consolidating GRC-related data from various sources provides a single, unified view of our risk and compliance posture. This addresses the challenge of data management due to siloed departmental data.

- Enable Real-time Monitoring: Advanced GRC tools, including Security Information and Event Management (SIEM) systems, can continuously monitor systems for vulnerabilities, security incidents, and compliance deviations, providing immediate alerts.

- Improve Reporting and Analytics: Dashboards and reporting features offer insights into GRC performance, helping us identify trends, anticipate risks, and make informed decisions.

- Facilitate Collaboration: Integrated platforms promote cross-functional collaboration, ensuring that legal, finance, IT, HR, and operational teams work together seamlessly.

The right technology transforms GRC from a burden into a strategic asset, allowing us to manage our risks more effectively and achieve principled performance.

Popular GRC Frameworks and Models

While the concept of GRC governance is universal, various frameworks and models exist to guide its implementation. These provide structured approaches for integrating governance, risk, and compliance activities:

- OCEG Capability Model (Red Book): Developed by OCEG, this open-source model (often called the Red Book) provides a comprehensive guide for planning, assessing, and improving GRC capabilities. It details a unified vocabulary, common components, and standardized practices. The GRC Capability Model (Red Book) helps professionals plan, assess, and improve GRC capabilities. We highly recommend exploring the GRC Capability Model (Free Open Source) for a foundational understanding.

- COSO (Committee of Sponsoring Organizations of the Treadway Commission): COSO provides frameworks for enterprise risk management (ERM) and internal control, widely used for financial reporting and fraud prevention.

- ISO 31000: An international standard for risk management, ISO 31000 provides principles and generic guidelines on managing risk. It’s applicable to any organization, regardless of its type, size, activity, or location.

- NIST Frameworks: The National Institute of Standards and Technology (NIST) publishes various frameworks and guidelines, particularly for cybersecurity and information security, which are crucial for GRC. These include NIST SP 800-37 Rev. 2 for risk management and NIST SP 1800 series for specific cybersecurity challenges. Our expertise in Cybersecurity Risk Management Frameworks often involves leveraging these standards.

Choosing the right framework often depends on our industry, regulatory environment, and specific organizational needs. Many organizations adopt a hybrid approach, combining elements from multiple frameworks to create a custom GRC strategy.

Conclusion: Achieving Principled Performance

In a world defined by accelerating change, escalating threats, and ever-increasing regulatory demands, GRC governance is no longer a luxury but a fundamental requirement for sustainable business success. It’s the strategic framework that transforms disparate functions into a unified, powerful force, enabling organizations to steer complexity with confidence and integrity.

We’ve seen that a siloed approach to governance, risk, and compliance leads to wasted resources, blind spots, and significant financial and reputational damage. Conversely, an integrated GRC framework delivers tangible benefits: reduced costs, improved decision-making, improved agility, and greater resilience. It’s about more than just avoiding pitfalls; it’s about reliably achieving our objectives, addressing uncertainty head-on, and consistently acting with integrity—what we call “Principled Performance.”

This journey towards integrated GRC governance is one of continuous improvement, demanding commitment from leadership, the strategic adoption of technology, and a culture that values transparency and accountability. By embracing these principles, we can not only protect our organizations but also position them for long-term growth and success.

At Concertium, we specialize in helping businesses like yours build and mature their GRC governance capabilities. With our deep expertise in cybersecurity services, including threat detection, compliance, and risk management, we can guide you through this complex landscape. Our unique Collective Coverage Suite (3CS), improved with AI-driven observability and automated threat eradication, provides the custom solutions you need to achieve principled performance.

Ready to transform your approach to governance, risk, and compliance? Let us help you integrate your efforts, improve your security posture, and drive your business objectives forward.

What is the difference between GRC and Enterprise Risk Management (ERM)?

ERM (Enterprise Risk Management) focuses specifically on identifying, assessing, mitigating, and monitoring risks across an entire organization. It's about understanding and managing all forms of risk that could impact objectives.

GRC (Governance, Risk, and Compliance) is a broader concept. While it certainly includes risk management, it integrates it with governance (how the organization is run, directed, and controlled) and compliance (adherence to rules and regulations). Think of ERM as a crucial component within the larger GRC framework. GRC provides the overarching structure and processes that enable effective ERM, ensuring that risk insights inform governance decisions and compliance efforts.

How do you measure the ROI of a GRC program?

Measuring the Return on Investment (ROI) of a GRC governance program can be both quantitative and qualitative:

Quantitative Metrics:

• Reduced Audit Costs: Streamlined processes and centralized data lead to more efficient audits.

• Lower Fines and Penalties: Proactive compliance significantly reduces the likelihood of regulatory penalties and legal fees.

• Improved Operational Efficiency: Eliminating redundant activities and automating processes saves time and resources.

• Faster Incident Response: Better risk management and clear governance procedures enable quicker and more effective responses to security incidents or compliance breaches, minimizing their impact.

• Cost of Unprincipled Performance Avoided: While hard to quantify precisely, avoiding the $1 trillion annual losses due to misconduct and errors is a significant ROI.

Qualitative Benefits:

• Improved Reputation and Trust: Strong GRC builds confidence among customers, investors, and partners.

• Improved Decision-Making: Better information leads to more strategic and risk-aware decisions.

• Increased Agility: The ability to adapt quickly to new regulations or market changes.

• Stronger Ethical Culture: A well-implemented GRC program fosters integrity and accountability.

By tracking these metrics and benefits, we can demonstrate the tangible value that GRC governance brings to the organization.

Is GRC only for large, highly regulated companies?

Nope! GRC isn’t just for big, regulated industries. Any business—large or small—faces risks, compliance needs, and governance challenges. A right-sized GRC approach helps SMBs improve efficiency, manage risks proactively, and build customer trust without enterprise-level complexity.